À propos du rôle d'évaluation foncière (ou rôle triennal d'évaluation)

Contenu de la page

Le rôle d'évaluation 2022-2023-2024 constitue un résumé de l'inventaire des immeubles du territoire.

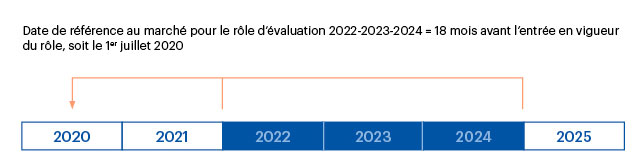

Il indique la valeur de chaque propriété sur la base de sa valeur réelle et des conditions du marché immobilier, selon une date précise : le 1er juillet 2020. Une fois établie, cette valeur sert de base pour déterminer la taxation municipale.

À noter que cette valeur ne reflète pas nécessairement la valeur marchande de votre propriété, notamment parce qu’elle réfère à une date passée.

Valeur du terrain et valeur du bâtiment

En

consultant le rôle d'évaluation ou l'avis d'évaluation de votre propriété, vous remarquez qu'une distinction est faite entre la valeur du terrain et la valeur du bâtiment. Pour le calcul des taxes municipales, cette distinction n'est pas importante.

Détermination de la valeur d'un terrain et d'un bâtiment résidentiel,107 ko

Détermination de la valeur d'un terrain et d'un bâtiment résidentiel,107 ko

Vidéo expliquant le rôle d'évaluation foncière

Cette vidéo n’a pas répondu à toutes vos questions?

Consultez la Foire aux questions (FAQ) portant sur l’évaluation foncière >

Faits saillants du rôle d'évaluation foncière 2022-2023-2024

- Date d'entrée en vigueur : le 1er janvier 2022

- Date de référence : 1er juillet 2020

- Augmentation moyenne de la valeur des propriétés par rapport au rôle précédent : 19,2 %

- Pourcentage d’immeubles désignés résidentiels sur le territoire : 76,7 %

- Augmentation moyenne de la valeur des résidences unifamiliales : 22,3 %

- Valeur moyenne d'une résidence unifamiliale : 441 000 $

Saviez-vous que...

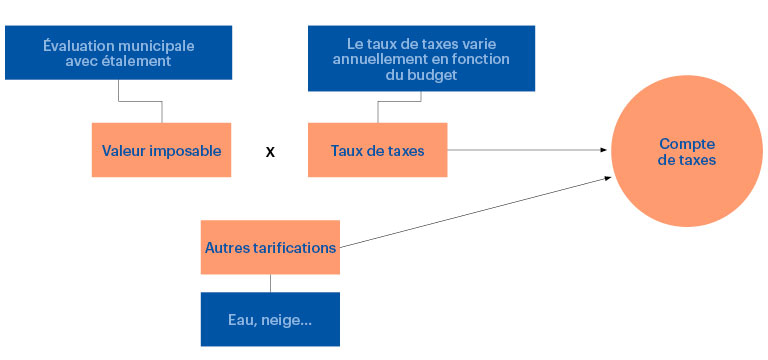

le dépôt d’un nouveau rôle d’évaluation a généralement peu d’impacts sur les charges fiscales auprès des contribuables? Le

taux de taxation n'est pas seulement déterminé sur la base des valeurs foncières. Il reflète les choix budgétaires faits annuellement par le conseil municipal en fonction du coût des services et des besoins de la population. De plus, les variations de valeur sont

étalées sur 3 ans à Laval. Si toutefois l’augmentation de la valeur d'une propriété est supérieure à l’augmentation moyenne de la valeur des propriétés d’une même catégorie, il est possible d'avoir une hausse de taxes plus importante que la moyenne. L’inverse est aussi vrai.

|